Golf course ownership has long been out of reach for most - but OmniCo Golf is changing that.

We’re fundraising to make strategic investments that enhance operations and fuel sustainable growth in the booming golf industry. By joining us as an investor, you can benefit from potential financial returns and be part of a movement breaking down traditional barriers.

This is more than an investment - it's a step toward making golf course ownership more inclusive, accessible, and community-driven.

Offering Circular (For US Investors)

Form C

View all filings

Amount Raised:

$~~

Offer Deadline: 10/31/2025

Type of Shares:

Common Stock

Target Minimum Raise Amount:

$10,000

Share Price:

$1.00

Maximum Raise Amount:

$1,235,000

Minimum Investment:

$500

Omnico Golf is a real estate investment and hospitality development company focused on the acquisition, revitalization, and repositioning of distressed or undervalued golf course properties in Florida and other high-growth markets. The company’s core business model centers around acquiring underperforming golf assets often overlooked by institutional buyers conducting targeted renovations, rebranding, and optimizing operations to create profitable, community-oriented recreational destinations.

The Company may also partner with or acquire golf course management firms, take on the operations of existing courses, or invest in franchise golf simulator businesses to diversify income streams. In select cases, underutilized golf course properties may be repositioned entirely for residential, commercial, or mixed-use development, depending on entitlements and market dynamics.

Our pilot market is the Tampa Bay region, where demand for golf and lifestyle amenities is fueled by population growth, new housing developments, and increased recreational spending. With a scalable, repeatable approach, Omnico Golf aims to build a diversified portfolio of revitalized golf course properties that generate revenue through golf operations, events, food and beverage (F&B), and, where feasible, real estate development or lodging.

Omnico Golf is a real estate investment and hospitality development company focused on the acquisition, revitalization, and repositioning of distressed or undervalued golf course properties in Florida and other high-growth markets. The company’s core business model centers around acquiring underperforming golf assets often overlooked by institutional buyers conducting targeted renovations, rebranding, and optimizing operations to create profitable, community-oriented recreational destinations.

The Company may also partner with or acquire golf course management firms, take on the operations of existing courses, or invest in franchise golf simulator businesses to diversify income streams. In select cases, underutilized golf course properties may be repositioned entirely for residential, commercial, or mixed-use development, depending on entitlements and market dynamics.

Our pilot market is the Tampa Bay region, where demand for golf and lifestyle amenities is fueled by population growth, new housing developments, and increased recreational spending. With a scalable, repeatable approach, Omnico Golf aims to build a diversified portfolio of revitalized golf course properties that generate revenue through golf operations, events, food and beverage (F&B), and, where feasible, real estate development or lodging.

PROBLEM

Breaking Down Barriers to Ownership

Golf course ownership has long been out of reach for many due to high financial barriers, systemic exclusion, and limited access to industry networks. The significant costs of acquiring and maintaining a golf property create steep hurdles, particularly for underrepresented groups. Historical practices have reinforced exclusivity, often sidelining women and minorities from real ownership opportunities. Additionally, the traditional golf industry has operated within closed circles, making entry into ownership a rare possibility for newcomers. OmniCo Golf exists to change that. By acquiring undervalued golf assets and offering inclusive, fractional ownership opportunities, OmniCo lowers the entry point for investors of all backgrounds. Through innovative structures, transparent reporting, and a commitment to community-driven investing, OmniCo is actively democratizing access to golf course ownership - creating a path where more people can not only play the game but also profit from it.

Disclosure: Omnico Golf will sometimes provide information based on unaudited financials, which are subject to change. This content is for informational purposes of Dutch and Amy’s business portfolio. Prospective investors should carefully review the Form C, visit https://omnicogolf.com/disclosures/.

OmniCo Golf is actively reshaping the landscape of golf course ownership by removing traditional barriers and opening doors for a more diverse range of investors. Through fractional ownership models, we significantly lower the financial threshold, making it possible for everyday individuals - not just institutional investors - to participate. Our inclusive investment structure is designed to welcome those historically excluded from the industry, including women and people of color. By leveraging transparent reporting, strategic education, and broad-based community engagement, OmniCo Golf connects new investors to real opportunities in an industry that’s ready for change. We're not just acquiring golf courses - we're building a more equitable future in golf ownership.

Lowering the cost of entry by offering fractional ownership opportunities, allowing everyday investors to buy into golf course assets with minimal capital.

Designed to welcome women, minorities, and first-time investors who have traditionally been excluded from golf ownership and investment networks.

Providing clear, accessible reporting and investor education to build confidence and understanding among new stakeholders.

Focusing on revitalizing local courses and engaging communities to create shared value through ownership, recreation, and economic impact.

PROBLEMS WE CAN FIX

Underutilized & Neglected Golf Course Assets

OmniCo Golf transforms neglected courses into profitable assets by acquiring underperforming properties and revitalizing them through strategic upgrades and operational efficiency. By offering fractional ownership, we open the door for everyday investors to co-own golf courses - breaking down traditional barriers to entry. The result is sustainable growth, stronger communities, and accessible wealth-building through real asset investment.

PROBLEMS WE CAN FIX

Underutilized & Neglected Golf Course Assets

OmniCo Golf transforms neglected courses into profitable assets by acquiring underperforming properties and revitalizing them through strategic upgrades and operational efficiency. By offering fractional ownership, we open the door for everyday investors to co-own golf courses - breaking down traditional barriers to entry. The result is sustainable growth, stronger communities, and accessible wealth-building through real asset investment.

Barriers to Entry for Average Investors in Golf Real Estate

For decades, golf course ownership has remained an exclusive opportunity reserved for the ultra-wealthy and accredited investors. The traditional model demands high upfront capital, complex operational oversight, and access to networks often closed to the average person. As a result, individuals who may have the desire - and even the financial means - to participate in golf real estate have found themselves shut out by institutional barriers and legacy investing structures.

OmniCo Golf is changing that. By introducing a fractional ownership model, OmniCo empowers everyday investors to gain a stake in professionally managed golf course assets. This innovative approach lowers the entry threshold while maintaining professional oversight and strategic scalability. Investors can now benefit from real asset appreciation, cashflow from diverse revenue streams, and participation in the upside of revitalized golf properties - without the burdens of direct ownership.

Barriers to Entry for Average Investors in Golf Real Estate

For decades, golf course ownership has remained an exclusive opportunity reserved for the ultra-wealthy and accredited investors. The traditional model demands high upfront capital, complex operational oversight, and access to networks often closed to the average person. As a result, individuals who may have the desire - and even the financial means - to participate in golf real estate have found themselves shut out by institutional barriers and legacy investing structures.

OmniCo Golf is changing that. By introducing a fractional ownership model, OmniCo empowers everyday investors to gain a stake in professionally managed golf course assets. This innovative approach lowers the entry threshold while maintaining professional oversight and strategic scalability. Investors can now benefit from real asset appreciation, cashflow from diverse revenue streams, and participation in the upside of revitalized golf properties - without the burdens of direct ownership.

Missed Revenue Opportunities from Poor Operational Strategy

Many golf courses today operate below their full potential due to outdated systems, inefficient processes, and a narrow focus on traditional income sources like green fees and memberships. These courses often overlook high-margin opportunities such as events, dining experiences, retail, and simulator golf. Without a modern, diversified operational strategy, even well-located clubs can experience stagnant revenue and rising maintenance costs - ultimately limiting long-term growth and investor returns.

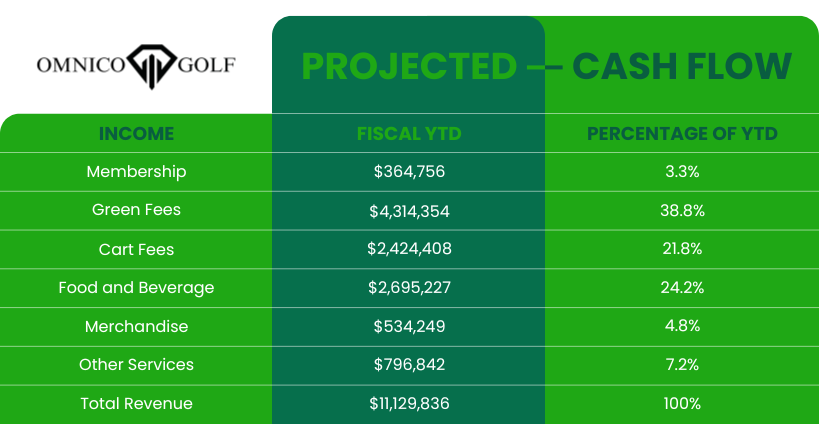

OmniCo Golf addresses this challenge head-on by implementing a vertically integrated operational model designed to unlock every layer of profitability. Through advanced customer management systems, targeted marketing, and operational streamlining, OmniCo enhances guest experience while increasing per-visitor revenue. Profit centers such as banquet facilities, golf simulators, merchandise sales, and food & beverage services are optimized to perform as cohesive, revenue-generating pillars - rather than disconnected afterthoughts.

Statistics

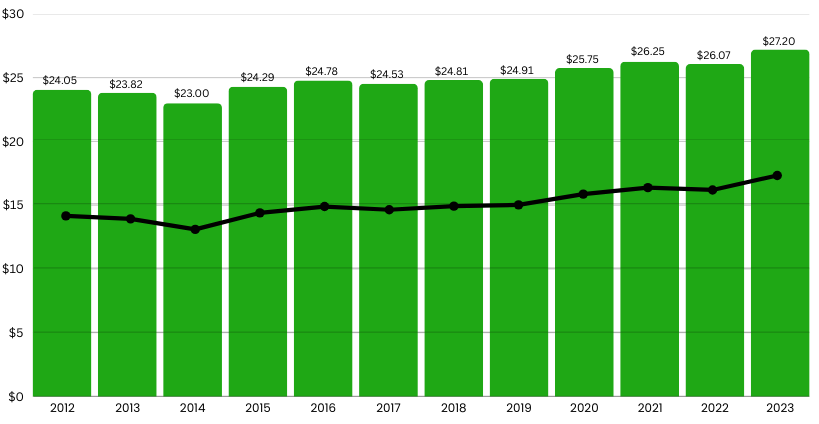

Market Size in The Golf Industry (in Billions) 2012-Current

Investors can anticipate consistent revenue growth over the next five years, driven by strategic investments and targeted operational enhancements. By infusing capital into our program, they play a direct role in scaling revenue-generating initiatives, improving efficiency, and supporting long-term, sustainable expansion. This opportunity is designed to deliver attractive returns, increased cash flow, and integrated revenue strategies that align with a forward-thinking investment approach. As we strengthen our market position and unlock new growth channels, investors benefit not only from financial gains but also from being part of an innovative, purpose-driven venture. With a clear roadmap and a seasoned leadership team, we’re positioned to maximize both impact and profitability.

Disclosure: The Company cannot promise future results, performance, or achievements. Anticipated returns, expense estimates, and investor distributions discussed in this business plan are based on the management’s assumptions, please review the Form for more, visit https://omnicogolf.com/disclosures/.

Source:

https://www.statista.com/topics/1672/golf/#topicOverview

https://www.ngf.org/monthly-rounds-played-reports/

The golf industry is experiencing a major resurgence, with participation and demand reaching all-time highs—yet many courses remain undervalued, neglected, or mismanaged. This disconnect creates a rare window for strategic acquisition and transformation. As interest in recreational real estate soars and fractional ownership becomes more mainstream, OmniCo Golf is positioned to capitalize on this momentum. Investors who move now have the chance to secure prime assets at low entry points before market competition intensifies and valuations rise. This is a once-in-a-cycle opportunity to turn overlooked golf properties into thriving, cash-flowing investments—while making golf more accessible for the future.

Copyright © 2024 Issuance Express. All rights reserved.

Securities offered under Regulation Crowdfunding under the Securities Act of 1933 are offered by Jumpstart Micro, Inc, d.b.a Issuance Express, a Funding Portal registered with the Securities and Exchange Commission and a member of FINRA. Under the regulation, Issuance Express acts as an Intermediary platform for Issuers (companies selling securities in compliance with the rules) and Investors (individuals purchasing services offered by Issuers). Issuance Express does not provide investment advice or make any investment recommendations to any persons, ever, and at no time does Issuance Express come into possession of Investor funds transferred directly to a bank escrow account. Issuers and Investors should carefully read our Disclosures, Educational Materials, and our site Privacy Policy and Terms of Use before using the Issuance Express funding portal.

Investors should weigh the risk of making investments, which includes the potential loss of your investment and the illiquid nature of non-public shares.

Dutch Mendenhall’s opinions and expressed views are his own.

The material contained in this presentation is confidential and furnished solely to consider an investment in Omni Management Co (the “Company”) and is not to be used for any other purpose or made available to any other person without the express written consent of the Company. The material is based in part on information supplied by the Company’s management and in part upon information obtained from sources deemed to be reliable, however, neither the Company nor its affiliates shall be deemed to have made any express or implied representations or warranties regarding this material whatsoever, including, without limitation, concerning accuracy and completeness.While the management believes the assumptions and forward-looking statements contained in this presentation are reasonable, the Company cannot promise future results, performance, or achievements. Anticipated returns, expense estimates, and investor distributions discussed in this business plan are based on the management’s assumptions and beliefs and are not reflective of past operations of this Company or affiliates.Summaries contained herein of any documents are unintended to be comprehensive statements of the terms of such documents, but rather only outlines of some of the principal provisions contained therein. Prospective investors should make their investigations, projections, and conclusions without reliance upon the material contained herein about future investments sponsored by the Company.The Company expressly maintains the right, at its sole discretion, to reject any or all expressions of interest or offers to invest in the Company or any project and/or terminate with any entity at any time with or without notice. The material herein is contingent upon change.

This is a test-the-waters solicitation of interest. No funds will be accepted and no payment is solicited as a part of the indication of interest by investors. If a future offering should ultimately be conducted, any indication of interest made here will not be considered a binding commitment to invest in said offering.

Securities offered under Regulation Crowdfunding under the Securities Act of 1933 are offered by Jumpstart Micro, Inc, d.b.a Issuance Express, a Funding Portal registered with the Securities and Exchange Commission and a member of FINRA. Under the regulation, Issuance Express acts as an Intermediary platform for Issuers (companies selling securities in compliance with the rules) and Investors (individuals purchasing services offered by Issuers). Issuance Express does not provide investment advice or make any investment recommendations to any persons, ever, and at no time does Issuance Express come into possession of Investor funds transferred directly to a bank escrow account. Issuers and Investors should carefully read our Disclosures, Educational Materials, and our site Privacy Policy and Terms of Use before using the Issuance Express funding portal.

Investors should weigh the risk of making investments, which includes the potential loss of your investment and the illiquid nature of non-public shares.